#

Proposal Mechanisms for Suppliers and Providers

Suppliers and Providers—also referred to as solvers—can make proposals to borrowers on Votre using two distinct mechanisms: Synchronous and Asynchronous.

Each method has its own flow, trade-offs, and ideal use cases.

#

🕒 Synchronous Proposals

In the synchronous model, Suppliers and Providers respond directly to specific borrower requests in real time.

#

How It Works

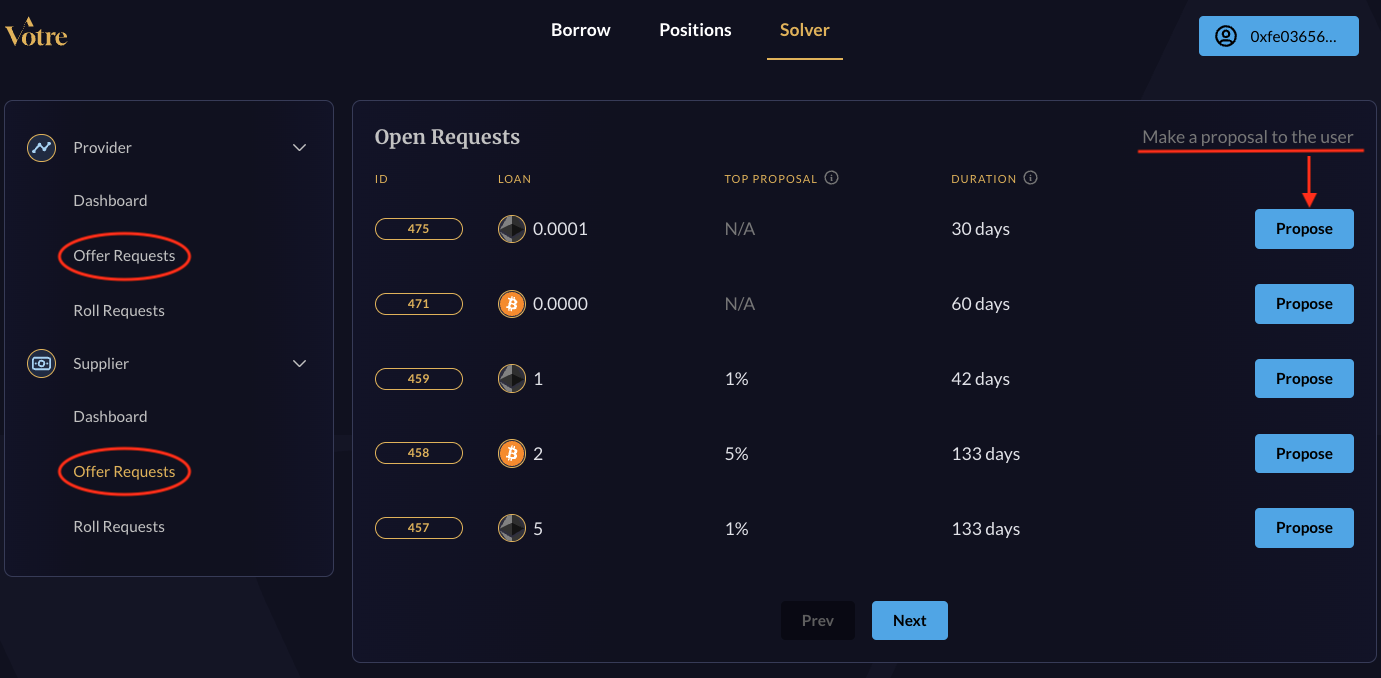

- Open loan requests from users appear in the Offer Requests tab for Suppliers and Providers.

- Upon viewing a request, solvers can send a proposal tailored to the user's ask by clicking the "Propose" button:

- Suppliers submit an Escrow Proposal, specifying:

- Interest APR

- Late Fee APR

- Grace Period (1–30 days)

- Providers submit a Callstrike Proposal, specifying:

- Cap (maximum loss)

- Suppliers submit an Escrow Proposal, specifying:

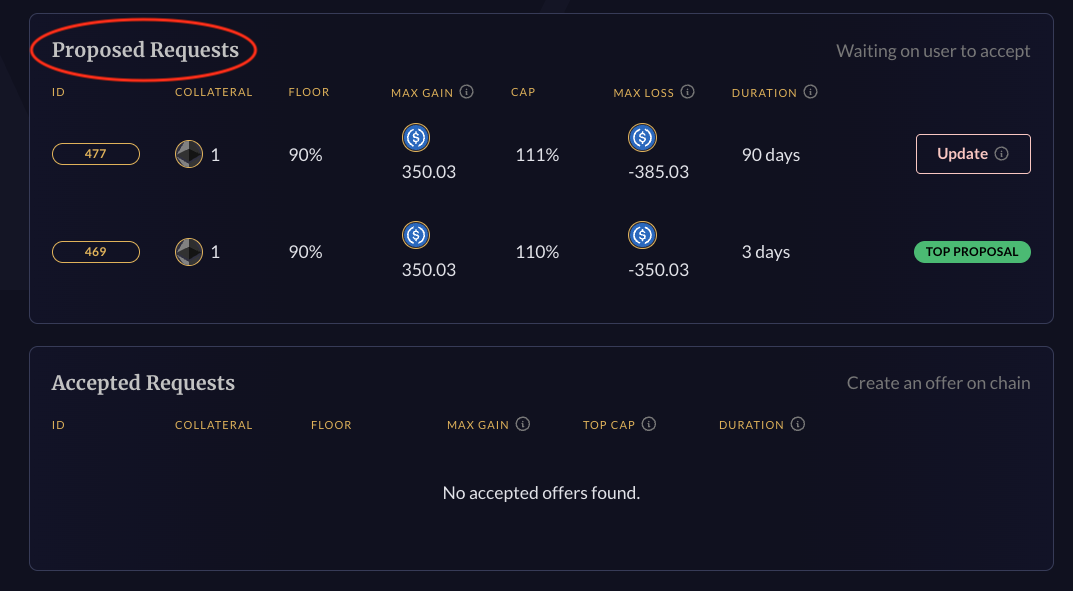

- Once submitted, the proposal will move from the Open Requests section to the Proposed Requests section and will be sent to the user, who can either accept or ignore it.

- The app let's Suppliers and Providers know if their proposal is the top offer or not, and will give them the option to update the proposal and provide the user better terms to win the bid for the loan.

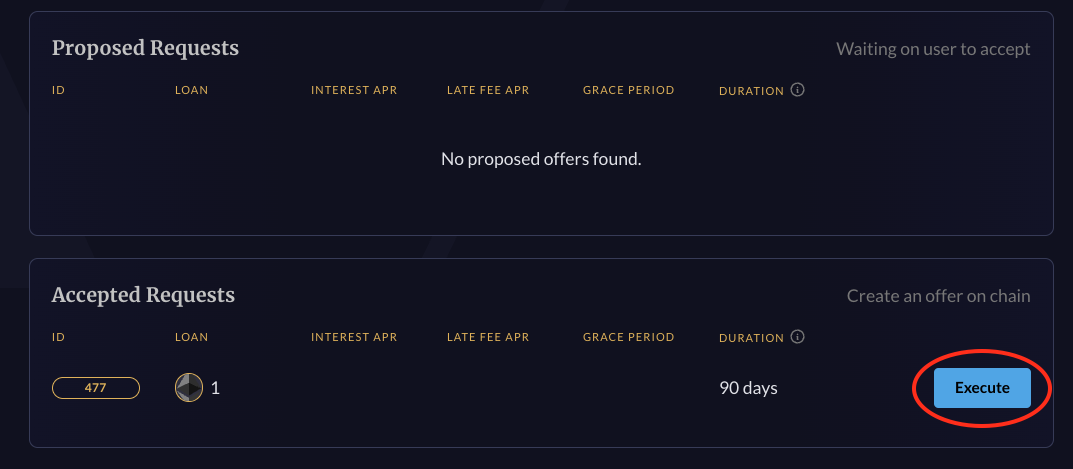

- If the user accepts the proposal, the proposal will move from the Proposed Requests to the Accepted Requests section.

- Once in this section, the Supplier or Provider whose offer was accepted by the user will execute the offer onchain by clicking the Execute button which will prompt an onchain signature.

- Once both the Supplier and Provider execute the request, the loan will commence.

#

✅ Pros

- Enables more customized proposals tailored to each user's loan request

- Creates competitive dynamics between Suppliers and Providers, potentially leading to better terms

- Capital is only locked when needed, meaning assets are committed just-in-time after a user expresses interest

#

❌ Cons

- Users must wait for proposals before moving forward in the loan process

- This delay increases the risk of user drop-off before a proposal is received, resulting in fewer completed loans

#

⚡ Asynchronous Proposals

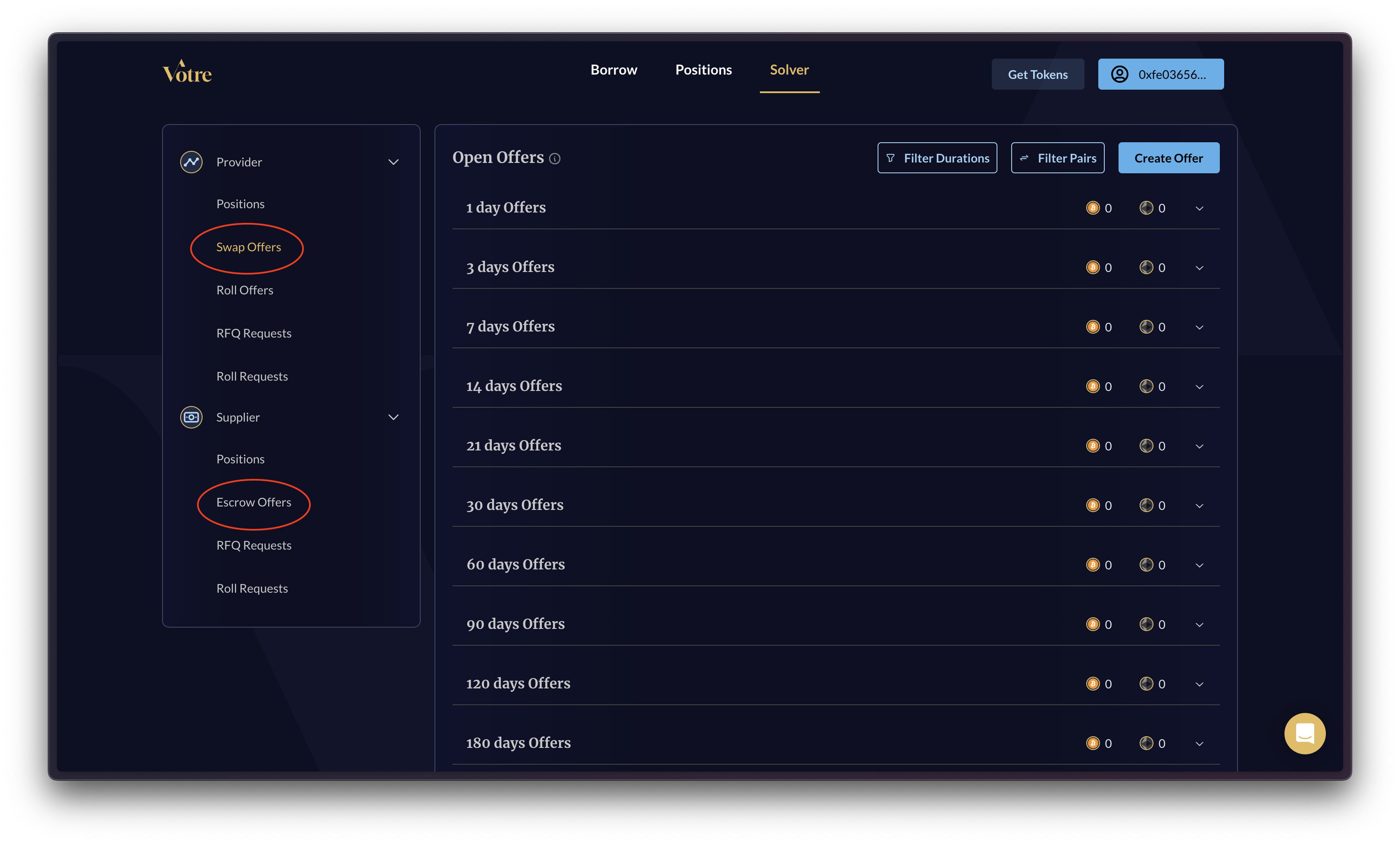

In the asynchronous model, Suppliers and Providers offer terms for theoretical loans in advance—before a user makes a specific request.

#

How It Works

- Solvers see a list of hypothetical loan configurations, grouped by the duration of the loan

- For each loan type, they can specify the terms they are willing to offer.

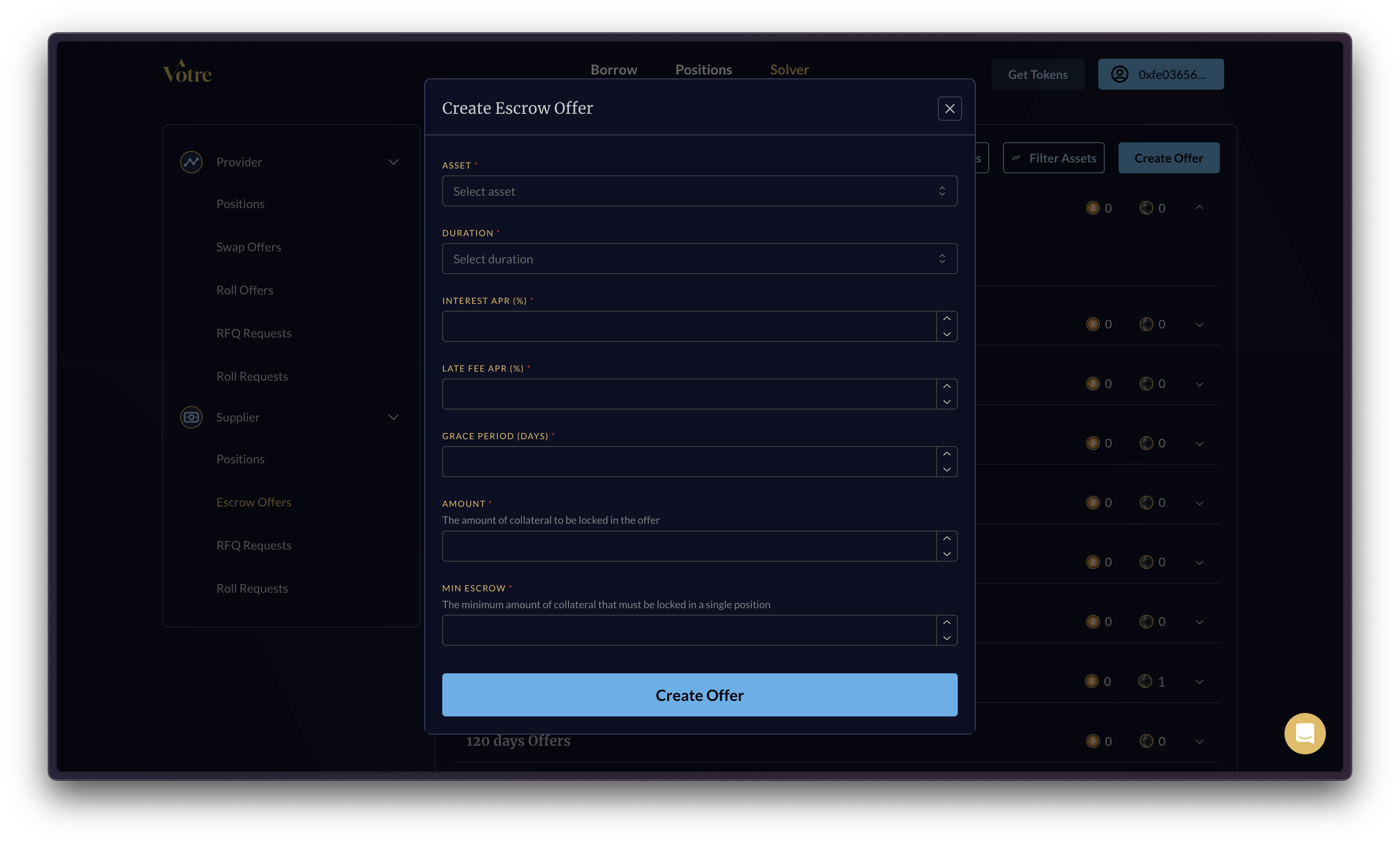

- Suppliers submit Escrow Offers, specifying:

- Interest APR

- Late Fee APR

- Grace Period (1–30 days)

- Amount (the amount of collateral to be locked in the offer)

- Min Escrow (the minimum amount of collateral that must be locked in a single position)

- Suppliers submit Escrow Offers, specifying:

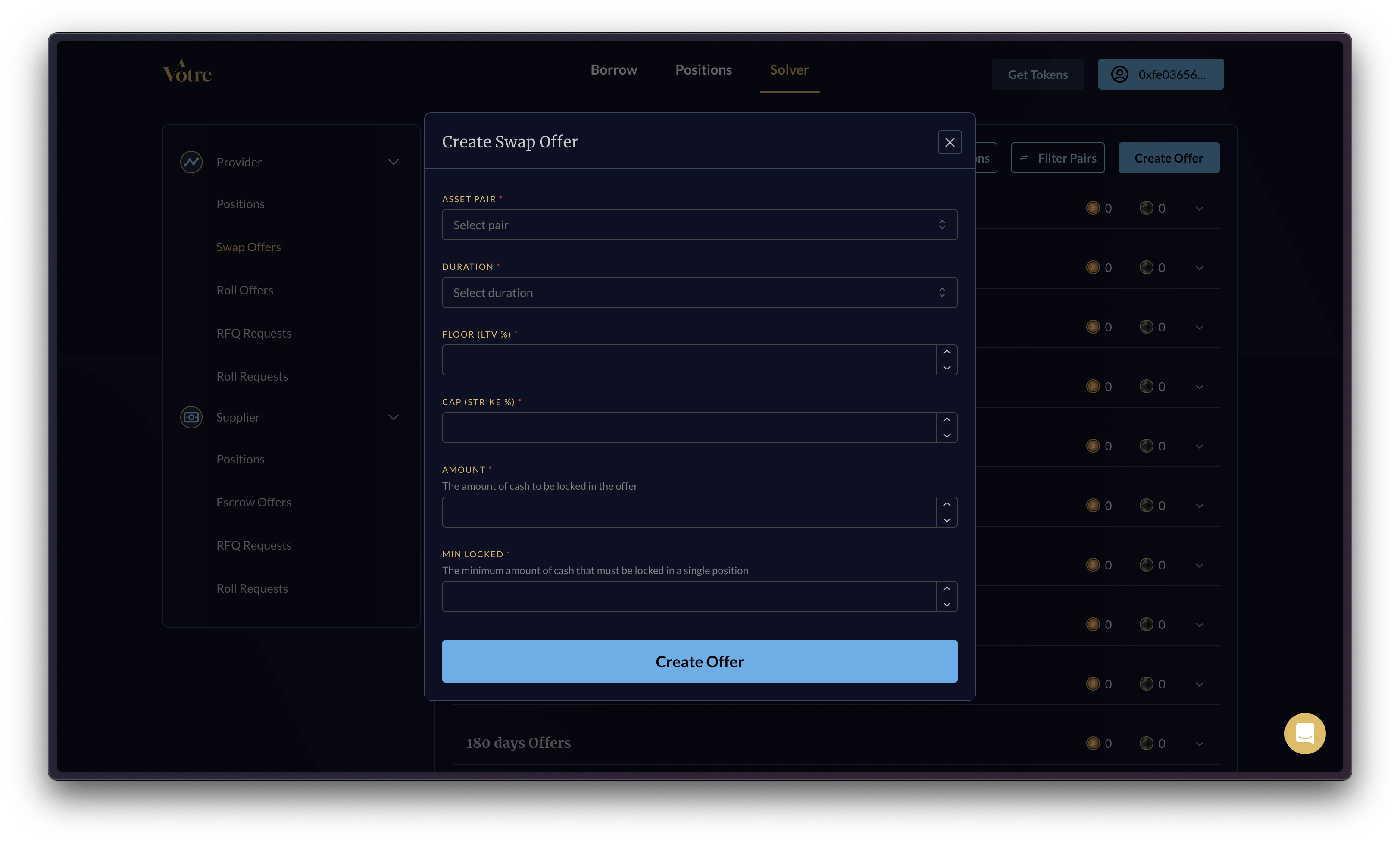

- Providers submit Swap Offers, specifying:

- Floor (LTV %)

- Cap (Strike %)

- Amount (the amount of cash to be locked in the offer)

- Min Locked (the minimum amount of cash that must be locked in a single position)

- These proposals are made ahead of time and remain active until accepted or depleted.

- When a user matches with a pre-submitted proposal, it is applied instantly.

- As proposals get accepted and filled, the associated capital allocation decreases, prompting solvers to "top off" to maintain availability.

#

✅ Pros

- Faster loan creation: Users often see immediate proposals that match their request

- Higher conversion rates due to reduced wait times

#

❌ Cons

- Users may not get the best possible terms, since offers are not tailored to their specific request

- Less room for customization, since terms are pre-submitted and fixed

- Capital must be pre-committed, which means solvers lock up assets before knowing if they’ll be used — potentially reducing capital efficiency

#

Summary

Both methods are active on Votre, and solvers are encouraged to participate in both to optimize reach and performance across all user types.