#

Rolling a Loan

#

What is Rolling a Loan?

Rolling a loan means repaying an existing loan by taking out a new one, typically with the same or updated terms, in order to extend the duration of the borrowing.

#

How to Roll a Loan

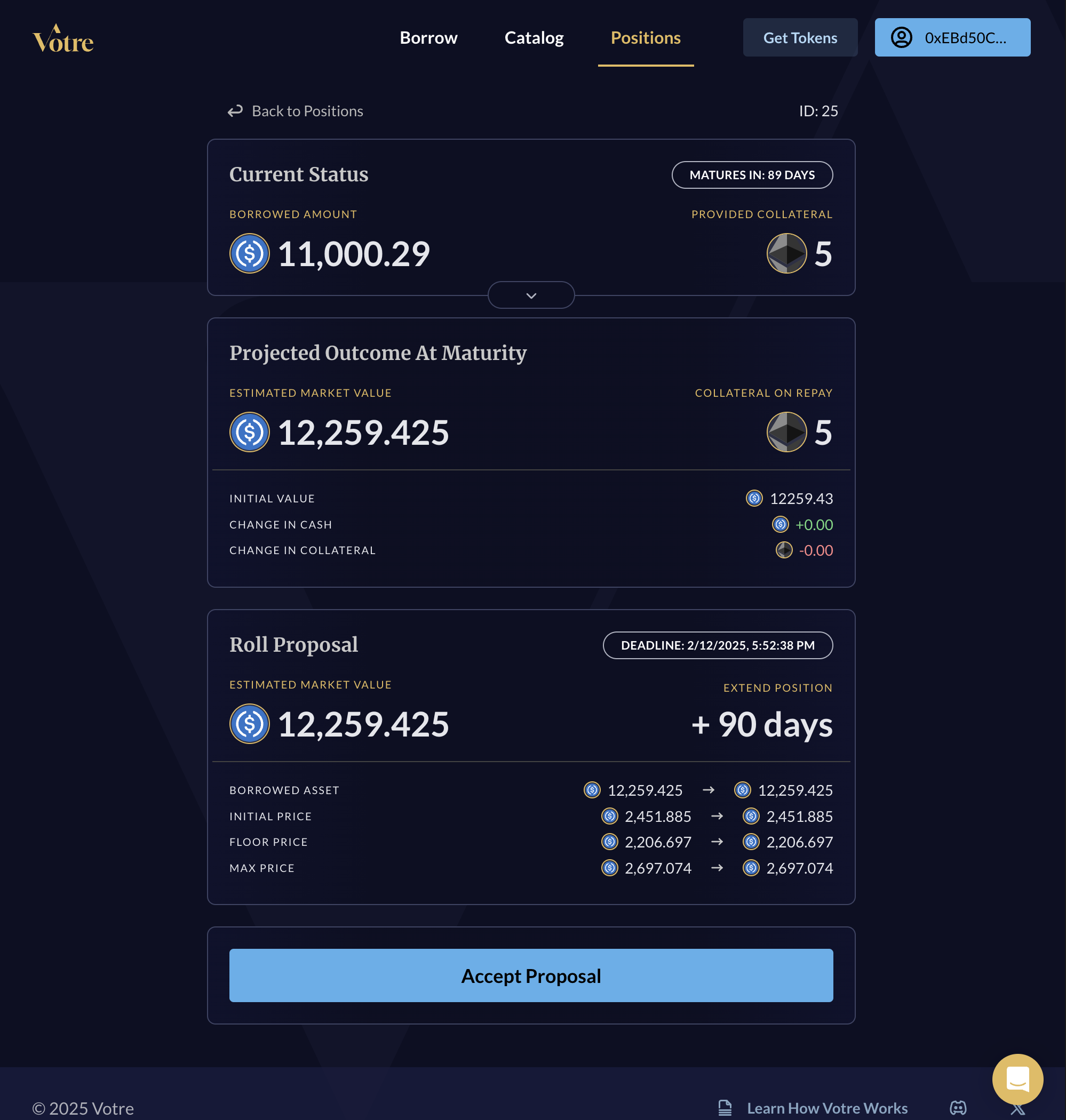

To roll a loan, look for a roll proposal on your loan details page.

#

Why Roll a Loan?

Rolling a loan can be a strategic financial decision for several reasons. Here's why you might need or want to roll a loan:

- Need More Time: If you need more time to repay your loan, rolling it can extend the loan term, providing you with additional time to manage your finances without defaulting.

- Cash Flow Management: Extending the loan term can help manage cash flow by reducing the immediate financial burden of large repayments.

- Better Interest Rates: If market conditions have changed since you took out the original loan, rolling it might allow you to secure a lower interest rate, reducing the overall cost of the loan.

- Flexible Repayment Options: Rolling a loan can offer more flexible repayment options that better align with your current financial situation.

- Simplified Payments: If you have multiple loans, rolling them into a single loan can simplify your payments, making it easier to manage your debt.

- Reduced Interest Costs: Consolidating loans can sometimes reduce the total interest paid over time, especially if the new loan has a lower interest rate.

- Preventing Penalties: If you're at risk of defaulting on your loan, rolling it can prevent penalties and negative impacts on your credit score by restructuring the debt.

- Investment Opportunities: If rolling a loan frees up capital, you might be able to take advantage of investment opportunities that could yield higher returns than the cost of the loan.

Rolling a loan should be considered carefully, weighing the benefits against any potential costs or risks. It's often advisable to consult with a financial advisor to ensure that rolling a loan aligns with your overall financial strategy.

Troubleshooting

For any questions or assistance, our support team is ready to help and answer any questions you may have. You can reach out to us on discord.